Fringe Benefits Tax and Logbooks

In this piece we will guide you through the fundamentals of FBT, preparing and managing logbooks, calculating business use percentages, and how electronic logbooks can help reduce FBT compliance costs and save employers money.

.jpeg)

Key Insights

- Employers do have an alternative option of calculating their FBT on company cars by using a Statutory Formula method that typically calculates the taxable value of a company car by multiplying the original cost of the vehicle by 20%.

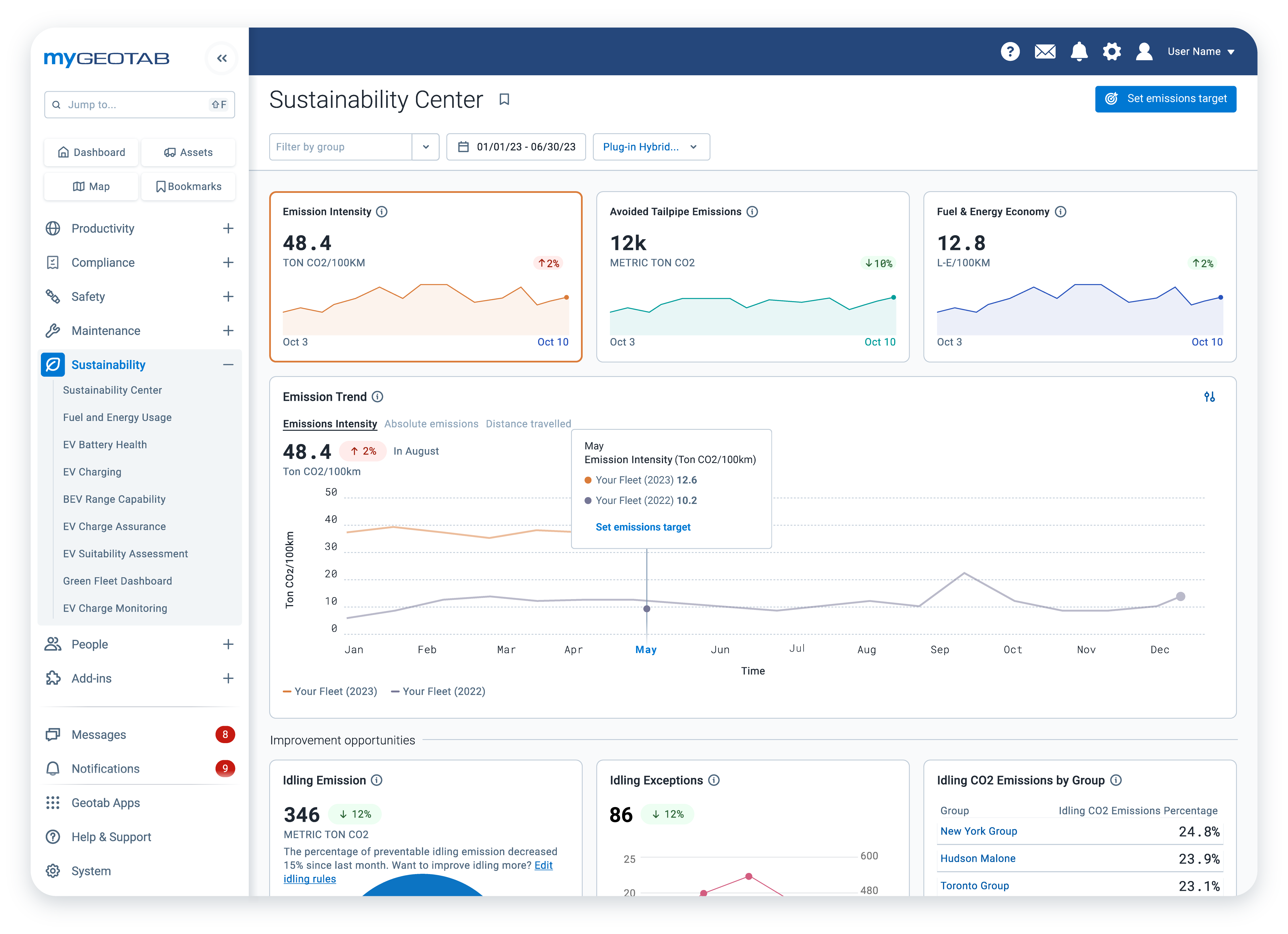

- Electronic logbooks streamline compliance and reduce costs: Digital solutions offer advantages like real-time tracking, GPS verification, and integration with fleet management systems, simplifying the logbook process and minimising administrative burdens.

- For fleet managers responsible for fleets of 20 or more vehicles, PCG 2016/10 provides an easier way to calculate the business use percentage component of the Operating Cost Method. Fleet managers can take advantage of PCG 2016/10 if certain conditions are met

Ensuring compliance with Fringe Benefits Tax (“FBT”) regulations is a critical aspect of managing an organisation's fleet of vehicles. Where employers seek to minimise the FBT they pay in respect of cars, one of the key pillars to achieving this is the creation and maintenance of logbooks that can be used to assess the extent of private use of a company car.

In this piece we will guide you through the fundamentals of FBT, preparing and managing logbooks, calculating business use percentages, and how electronic logbooks can help reduce FBT compliance costs and save employers money.

FBT and logbooks

FBT is a type of tax employer’s pay on certain benefits they provide to their employees, including the private use of company cars. Logbooks become relevant when employers seek to calculate their FBT in reference to the costs of operating the vehicle but wish to limit the taxable amount to operating costs that relate to private use. Also known as the Operating Cost Method.

Employers do have an alternative option of calculating their FBT on company cars by using a Statutory Formula method that typically calculates the taxable value of a company car by multiplying the original cost of the vehicle by 20%.

This method is always available to employers, but where operating costs can be quantified, the employer has freedom to choose the method that yields the smaller amount of tax. This provides a great opportunity to save tax. However, alongside having details of the vehicle’s operating costs, it is also important to be able to isolate the private operating costs (otherwise all operating costs are taxable).

Example

If a vehicle’s base cost is $80,000 (including GST) and its annual operating costs are $16,000 (including GST) a year, the taxable value of the vehicle will be:

- Statutory Formula Method: $80,000 x 20% = $16,000 to be factored into the FBT analysis

- Operating Cost Method: $16,000 to be factored into the FBT analysis

In this scenario, the same amount of $16,000 would be factored into the FBT calculations and the same amount of tax would be payable.

Example 2

Same facts as example 1, but if we now know that the extent of private use of the car is limited to 30% of kilometres travelled as evidenced by a valid logbook, the calculation becomes:

- Statutory formula: $80,000 x 20% = $16,000 to be factored into the FBT analysis

- Operating Cost Method: $16,000 x 30% = $4,800 to be factored into the FBT analysis

Since the 20% Statutory Formula method does not allow the employer to be given credit for the vehicle being used primarily for business purposes, the calculation does not change. However, the Operating Cost Method can factor in business use and only seeks to tax private use, meaning the tax outcome can be far more preferable. For instance, in this example, the amount that will be factored into the FBT calculations is $4,800 instead of $16,000. Without a way of evidencing the private use of the vehicle, the amount would remain $16,000.

The remainder of this article focuses on scenarios where the Operating Cost Method is used to calculate FBT on company cars with a carrying capacity of less than one tonne or capable of carrying fewer than 9 passengers.

As already discussed and illustrated by way of an example, when using the Operating Cost Method, it is important that the business use percentage is calculated. Given the benefits that having a private use percentage can bring, the Australian Taxation Office (ATO) mandates that companies maintain detailed logbooks that record the business and private use of each vehicle when an employer intends to use a business use percentage other than 100%.

To be able to prepare and manage valid, compliant logbooks, fleet managers should ensure that each vehicle’s logbook includes:

- The date each journey began and ended

- Odometer readings at the start and end of each journey

- Kilometres travelled

- Purpose of the journey

Logbooks must be maintained for a continuous period of at least 12-weeks, although many employers will ask employees to maintain logbooks all year round.

Calculating the private use percentage simply involves dividing the distance travelled for private reasons by the total distance travelled and converting this figure to a percentage (ie multiplying by 100).

Save Time and Cost - Electronic Logbooks

Developments in technology have made obtaining employee logbooks to generate private use percentages easier than ever and what was once a pain point for fleet managers and tax managers is now relatively straightforward. Compliant logbooks can be produced without the use of a single sheet of paper! Electronic logbooks offer several advantages over traditional paper-based logbooks such as: accuracy, convenience, accessibility, availability of real-time data, GPS-backed integrity, integration with fleet management platforms and cost savings.

With electronic logbooks, fleet managers and employees can easily record and access journey details through a smartphone app, promoting consistent and timely data entries. Additionally, electronic logbooks provide real-time tracking of vehicle usage, allowing fleet managers to monitor and analyse data instantly, facilitating improved compliance management. This real-time data not only ensures that all journeys are accurately recorded but also helps in calculating the private use percentage with precision (which is crucial for determining FBT liabilities).

By utilising electronic logbooks, fleet managers can reduce administrative costs associated with maintaining paper logbooks and improve the overall efficiency of their fleet management processes. Accurate business use recording helps in substantiating the business proportion of vehicle use, leading to significant FBT savings by reducing the taxable value of car benefits.

When selecting an electronic logbook provider, fleet managers should ensure the provider of the solution has obtained a class ruling from the ATO. ATO Class Ruling 2024/2 confirms the Geotab Drive FBT report can be utilised to reduce the operating costs in both a logbook and non-logbook year of tax for the purpose of calculating the taxable value of a car benefit. What this practically means is that, as long as how the vehicle is used does not materially change from year to year, a logbook kept in one year can be relied upon for up to the next four years also.

The class ruling also confirms that the Geotab FBT report satisfies the ATO’s definition of logbook and odometer records.

Additionally, selecting a provider that prioritises data security and privacy, such as Geotab, ensures that sensitive information is protected. Reliable customer support and regular software updates also help maintain compliance with changing regulations and technological advancements.

Practical Guidance for Fleet Managers

Even where best efforts are made to obtain a full set of valid logbooks, there can be instances where this does not occur.

Since managing a large fleet of vehicles can be challenging, the ATO has also introduced a simplified approach. For fleet managers responsible for fleets of 20 or more vehicles, PCG 2016/10 provides an easier way to calculate the business use percentage component of the Operating Cost Method. Fleet managers can take advantage of PCG 2016/10 if certain conditions are met, the main ones being:

- The cars are “tools of trade” cars (ie. used extensively by the employee in their job);

- Valid logbooks are held for at least 75% of the cars in the logbook year;

- Each car in the fleet had a GST-inclusive value less than the luxury car tax threshold applicable at the time the car was acquired; and

- The cars are not provided as part of an employee’s remuneration package.

Where the criteria are met, fleet managers are able to apply an average business use percentage to all tools of trade cars held in the fleet in the logbook year and the following four years. This simplified record-keeping approach can be applied for a period of five years provided the fleet remains at 20 cars or more, and with no substantial changes to the business use percentage of the fleet.

Note: this guideline only applies to fleets with 20 or more cars, not vehicles which are not considered cars for FBT purposes.

How does any of this help employees?

While the employer pays FBT on the benefits it provides, employees still have the amount of reportable fringe benefits they receive reported on their annual income statement as a Reportable Fringe Benefit Amount (RFBA). This can impact eligibility for certain means-tested benefits and superannuation, the amount of Medicare levy Surcharge someone pays and the amount of additional tax they pay on concessional superannuation contributions.

As such, employees should be aligned with their employer in the benefits that can be achieved from reducing the amount of tax to the correct level calculated in reference to operating those costs, but only the percentage of those that relate to the private use of the car.

Closing remarks

- Ensuring compliance with FBT legislation is a crucial responsibility for organisations.

- Really material savings can be made where an employer uses the Operating Cost Method to calculate car fringe benefits.

- These material savings rely on accurate and well-maintained logbooks.

- Historically logbooks were a pain point for organisations, with completion rates low and concerns often existing around the integrity of those that were completed. The result of this was that many organisations paid much more tax than was necessary due to the absence of reliable, compliant logbooks.

- Digital logbooks have completely changed the landscape and organisations that have never used the Operating Cost Method to calculate FBT, or stopped using it due to the challenges associated with paper logbooks, are embracing new technology to reduce their tax bill.

- Employees should be aligned with their employer’s willingness to reduce the amount of FBT they pay as it has the potential to benefit them personally

General ATO guidance and information on FBT, logbooks and cars, can be found here: Fringe benefits tax - a guide for employers | Legal database.

The information in this article is of a general nature and is not intended to address the specific circumstances of any particular individual or entity. Appropriate professional advice should be obtained before acting on this information.

Article contributor: KPMG Australia

The Geotab Team write about company news.

Related posts

Geotab becomes a certified Telematics Monitoring Application Service Provider

April 1, 2025

3 minute read

From Rebates to Road Safety: A Guide to Optimising Your Council Fleet

March 24, 2025

1 minute read

Sustainability Centre: central hub for sustainable fleet management

January 28, 2025

2 minute read

Geotab at MEGATRANS discusses Cost Savings and Automation

September 24, 2024

1 minute read

Electric vehicle sales double in Australia: here are three trends in EV adoption

September 8, 2024

2 minute read