Benefits of telematics: the financial argument

Use these three simple metrics to jumpstart an assessment of how telematics can deliver value to shareholders: ROE, profit per vehicle, and sales per vehicle.

By Geotab Team

Dec 22, 2023

We often hear about the potential of telematics to help commercial vehicle fleets cut costs and operate more efficiently. Companies that deploy telematics solutions to improve the operation of their commercial vehicle fleets, often conclude that when, for example, a fleet reduces fuel costs, it operates more efficiently.

However, such examples of cost reduction and efficiency present an incomplete view of the potential of a telematics solution to improve a company’s financial performance. Shareholder value, by contrast, represents a more powerful starting point for capturing the scope and potential of a telematics deployment to improve a company’s financial performance.

See Also: Showing the Value of Employee GPS Tracking

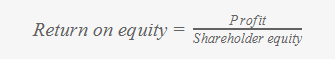

What Is Return on Equity?

Return on equity (ROE) demonstrates in financial terms how telematics delivers value to shareholders, capturing the full scope of telematics to improve financial performance. In contrast to return on investment (ROI), ROE assesses the impact of telematics within the entire organization instead of a single project.

Return on Equity Formula

When separated into three parts, ROE demonstrates the link between profit and shareholder value.

Profit, or net income, represents income minus expenses measured on an accrual basis.

The definition of shareholder equity is assets minus liabilities, a basic measure of shareholder value. It is different from market capitalization, another measure of shareholder value defined as the number of outstanding shares multiplied by the price per share.

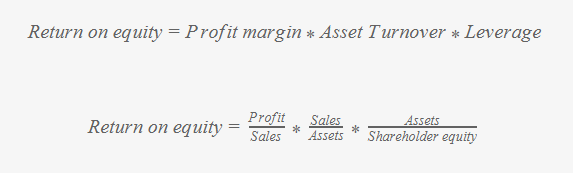

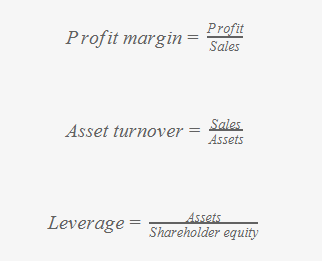

To relate this to telematics and fleet management, we can decompose ROE into three ratios, profit margin, asset turnover, and leverage, a technique known as the Dupont Model.

Where:

With this definition in place, we can explore how telematics drives ROE for end users.

How Telematics Impacts Shareholder Value

ROE links the income statement with the balance sheet, providing companies that operate commercial vehicles fleets with a more robust view of the financial performance of their operation. In the ROE model, sales and profit are income statement items while assets and shareholder equity are balance sheet items.

By measuring the ratio of sales to total assets, asset turnover connects the two financial statements, creating a crucial link to shareholder value. This is clearly seen by examining specific financial items.

In many cases, vehicle fleets impact sales (i.e. revenue) for a company. At Geotab, we often work with sales and service fleets that interact directly with customers and distribution partners. A key measure of performance for the end user is the amount of revenue that they generate (the sales component of ROE). Expense items like fuel, insurance, and driver compensation directly impact profitability. Together, sales and expenses drive the profitability component of ROE.

Moving to asset utilization, while exceptions exist for end users who outsource fleet operations or rely heavily on operating leases, vehicles are assets for most end users. Maintenance and capital investment decisions drive the value of these assets by influencing their book value, salvage value, and depreciation rate (independent of tax considerations).

In the second component of ROE, asset turnover measures the efficiency with which a company deploys its assets to generate revenue. Returning to the original example of fuel costs, it is important to note that fuel costs are unrelated to asset turnover. To capture this relationship, one can combine the profitability and asset turnover components of the ROE model to reveal return on assets.

In the third component of ROE, leverage, analyzing various vehicle financing alternatives, including whether to purchase or lease vehicles, can influence the leverage ratio. In practice, however, the value of leasing lies more in its potential for companies to focus on their core competencies than engineer financial performance. By integrating these different components into a single model, one can clearly express the link between commercial vehicle operations and shareholder value.

ROE vs ROI

ROE is often more successful than ROI in evaluating the financial benefits of telematics and convincing end users of a technology’s value. With ROI, an organization compares its investment in a telematics solution with the projected financial gains from the solution.

In theory, if the project exceeds a hurdle rate, the company should pursue the project. ROI calculations are unable to explicitly answer the question of how telematics benefits shareholders. Benefits are often a mixture of qualitative and quantitative conjectures that loosely fit together.

Examples of Specific Telematics Features that Drive ROE

Geotab’s advanced telematics platform provides features that drive ROE for end users. Some examples include:

- Safety — Unsafe driving has a tremendous effect on the financial performance of end users, including tangible costs, reputational costs that impact sales, and asset write-downs and write-offs. Geotab technology and reporting capabilities have an outstanding track record for delivering financial results to end users that impact ROE.

- Route Planning and Optimization — Route planning and optimization are two of the most important activities for increasing the capacity of commercial vehicles and increasing asset efficiency. Leveraging both proprietary tools and its world class ecosystem, Geotab allows its end users to do more with less vehicles through route planning and optimization.

- Maintenance — The engine data and related statistics concerning vehicle usage that Geotab delivers to end users ensures that scheduled maintenance is performed while minimizing non-routine maintenance. These features increase vehicle life and salvage value for vehicles, improving asset efficiency.

- Fuel Savings — Leveraging engine data, location data, and Marketplace solutions, Geotab allows end users to monitor fuel usage and optimize factors that influence fuel efficiency, including tire pressure, harsh acceleration, gear selection, and idling. Read more on fleet optimization here.

Recommended for you: How CFOs Can Build a Better Budget with Telematics

Who Benefits from an ROE Perspective?

An orientation towards ROE benefits the entire telematics ecosystem. For companies assessing the value of telematics, it is imperative to consider the impact that telematics has on ROE.

For a senior executive considering the potential of this technology, shareholder value will be an important consideration.

For internal champions promoting telematics within their organizations, a business case that emphasizes the drivers of ROE communicates the true financial impact of the solution while demonstrating business acumen.

For channel partners, it is critical to propose solutions that offer a differentiated view on how to add value to the company. Incorporating ROE strengthens the value proposition to influential customer segments, i.e., those who are responsible for maximizing shareholder value.

For marketplace partners, ROE provides an important guide to product development, sales, and marketing.

Conclusion

In practice, there are three simple metrics that jumpstart an assessment of how telematics can deliver value to shareholders: ROE, profit per vehicle, and sales per vehicle. These metrics are exceedingly simple to calculate and enhance the financial and operational analysis of commercial fleet performance. The crucial simplification involves substituting the number of vehicles in the end user’s fleet for asset book values.

Determining book values for an end user's fleet can be an involved process, while number of vehicles should require minimal analysis. Profit per vehicle combines and simplifies the profitability and asset turnover components of ROE to capture both cost savings and efficiency. Sales per vehicle restates asset turnover in a way that provides a clear indicator of fleet efficiency.

Crucially, these metrics measure an end user’s ability to create the real option to reduce fleet size or drive growth through increased vehicle utilization. Together, these metrics drive the argument for how telematics delivers shareholder value through ROE.

Related:

Telematics benefits for the greater good

Subscribe to get industry tips and insights

The Geotab Team write about company news.

Table of Contents

Subscribe to get industry tips and insights

Related posts

14 Fleet management key performance indicators you should track to boost efficiency

December 1, 2025

7 minute read

Strengthen high-value cargo security with advanced telematics

August 12, 2025

4 minute read

Autonomous trucking: The impact of self-driving trucks in the freight industry + guide

July 30, 2025

6 minute read