How AI-based in-cab video can lower fleet insurance costs and improve safety

Fleets are adopting video telematics in partnerships with their insurers to reduce risky driving, collision costs and legal liability.

Key Insights

- AI dash cams reduce legal risk by providing video evidence that helps fleets fight false claims and lower insurance costs.

- Insurance companies are requiring video telematics data to assess fleet safety and set insurance premiums.

- Insurers are more willing to offer credits and other discounts, when fleets show tangible progress in reducing risky driving.

Insurance rates keep climbing, hitting fleets with higher premiums and stricter coverage. A single serious collision can send premiums and other costs spiraling. Fleet operators know the risks. Insurance premiums climb. Legal battles drain time and money. One claim can reshape a fleet’s entire financial outlook. In-cab video that uses AI is helping fleets take control, reducing collision rates, lowering legal exposure and securing better insurance rates.

Why AI dash cams lower fleet insurance costs

Insurers calculate premiums based on risk. More claims mean higher costs. Dash cams using AI provide real-time safety data, helping fleets prove they’re taking steps to minimize risk. Fleets that prove safer driving habits and fewer incidents often secure lower premiums and fewer disputes.

- Fewer incidents, fewer claims – AI video telematics detect risky driving behaviors, reducing preventable accidents by up to 30% in the first year.

- Stronger legal defense – When accidents happen, video footage clarifies fault, shutting down fraudulent claims. With 80% of truck accidents caused by passenger vehicles, this evidence protects drivers and prevents unnecessary payouts.

- Premium reductions – Insurance companies offer significant discounts for fleets using AI dash cams. Progressive, HDVI, and other providers give fleets 5-20% savings for sharing video data.

The rising cost of collisions

In 2022, the average DOT-reportable collision cost $18,000. The FMCSA reports that for large trucks, the average cost of a non-injury collision was approximately $46,765, while crashes involving injuries averaged $404,863.

Nuclear verdicts which are legal judgments exceeding $10 million, are becoming more common in the trucking industry. These massive payouts often result from incidents where juries assign extreme financial penalties to fleets, even when fault is disputed. Insurers are taking note, tightening underwriting standards, and raising premiums for fleets without strong safety measures in place.

The DOT requires carriers to report collisions involving a fatality, an injury requiring medical attention away from the scene, or a vehicle being towed due to damage. Even when collisions don’t meet these thresholds, frequent minor claims still increase a fleet’s overall risk and drive up renewal premiums.

How AI dash cams improve fleet safety and prevent collisions

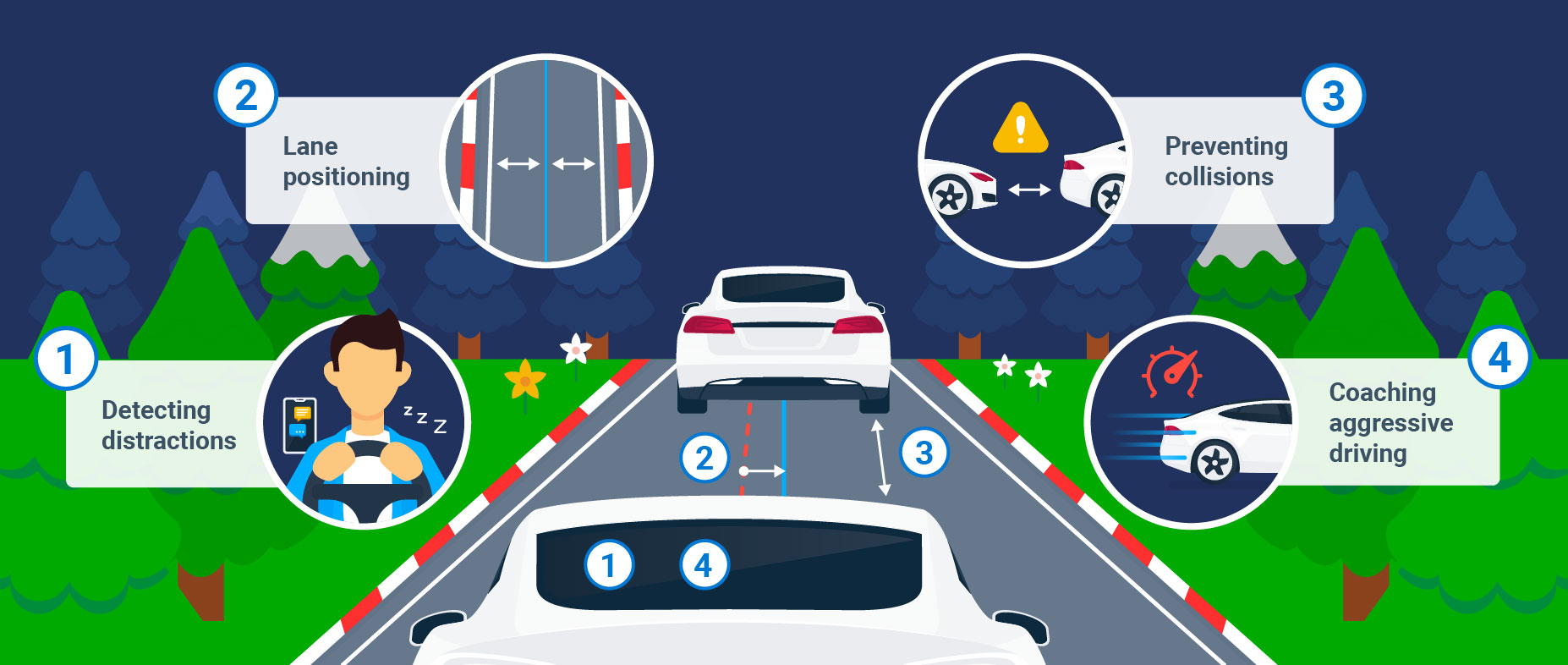

AI dash cams act as an extra set of eyes on the road, identifying dangers before they turn into major incidents. They track driver behavior, recognize risky patterns and provide real-time coaching. The end goal is fewer collisions, safer roads and lower costs. Here’s how they help:

- Detecting distractions – Cameras spot when a driver is looking at a phone, nodding off or losing focus, triggering alerts to refocus attention.

- Preventing collisions – Sensors measure the distance between vehicles and warn drivers when they get too close.

- Keeping lanes in check – AI tracks lane positioning and sends alerts if a vehicle starts drifting.

- Tracking and coaching aggressive driving – Hard braking, sudden acceleration and sharp turns are flagged and pushed to fleet managers who can provide targeted coaching to correct unsafe habits.

Dual-facing dash cams have become the standard in trucking, providing both road and in-cab views to give a full picture of events. Other sectors in transportation and logistics are also adopting road-facing cameras to improve safety and accountability.

Insurers are paying attention

Insurance companies have struggled with rising claim payouts, and many now require fleets to adopt video telematics. Others offer financial incentives to encourage adoption.

The commercial auto insurance market has remained unprofitable in recent years. In 2023, it was the third-largest segment in the U.S. commercial insurance market, generating $55 billion in net written premiums. However, the industry has struggled with unprofitability, reaching a combined ratio of 109.2%, meaning insurers are paying out 9.2% more than they collect in premiums. These financial pressures are pushing insurers to demand stronger risk management from fleets

Insurers offering incentives for AI dash cams

Many insurance providers recognize the value of AI dash cams in reducing risk and improving fleet safety. While some insurers require fleets to install video telematics to qualify for coverage, others offer discounts and incentives for fleets that can demonstrate safer driving habits and fewer claims. Fleets that invest in video telematics may see lower premiums, improved policy options and a better position when negotiating rates.

The impact of AI dash cams on insurance costs

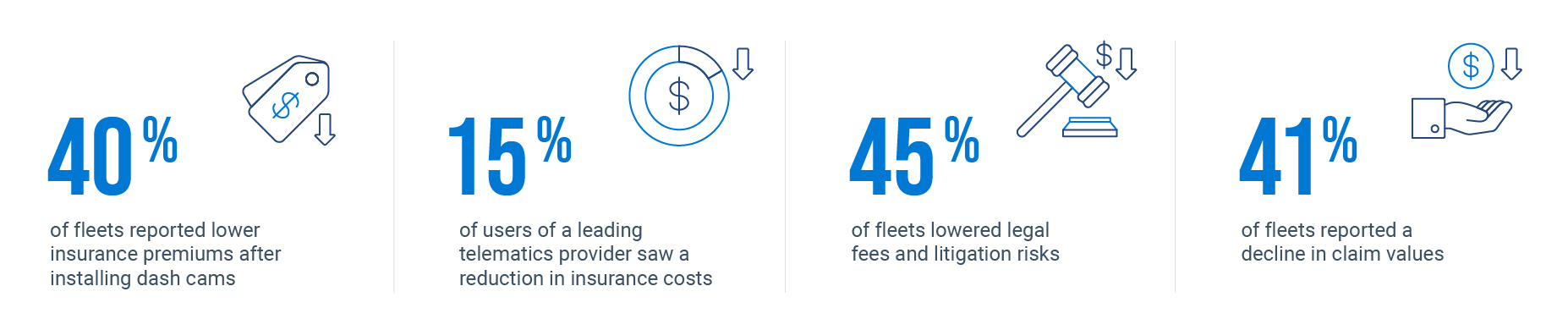

A FreightWaves survey highlights how AI dash cams are reducing financial risks for fleets:

- 40% of fleets reported lower insurance premiums after installing dash cams.

- 15% of users of a leading telematics provider saw a reduction in insurance costs.

- 45% of fleets lowered legal fees and litigation risks.

- 41% of fleets reported a decline in claim values.

As insurance rates continue to rise, fleets that fail to adopt risk-reduction measures may face higher premiums or limited policy options. Insurers are actively adjusting their underwriting strategies, favoring fleets that invest in safety technology.

What this means for fleets

In addition to improving safety AI dash cams provide financial benefits by reducing claims, limiting legal exposure and securing lower premiums. Fleets investing in video telematics are staying competitive and keeping costs under control.

Looking for lower insurance costs? Learn how Geotab's comprehensive video and telematics solutions offer the data and analytics needed to improve safety, reduce claims, and strengthen your fleet’s risk profile.

Subscribe to get industry tips and insights

Table of Contents

Subscribe to get industry tips and insights

Related posts

Unlocking Safer Roads: How Behavioral Science and Technology Are Improving Driver Safety

April 14, 2025

2 minute read

Beyond the road: Enhancing school bus interior safety with advanced technology

April 10, 2025

5 minute read

Enhancing student bus safety: Combating distracted driving in the digital age

April 7, 2025

6 minute read

How a well-built fleet safety culture prevents legal trouble

March 28, 2025

5 minute read

Driver behavior monitoring systems: Fleet managers’ guide for top tools + implementation tips

March 27, 2025

7 minute read