Top seven fleet fuel cards: Which is right for your fleet? A complete guide

How much does your business spend on fuel each month? Learn how fleet fuel cards can help you save money and improve fleet efficiency.

Key Insights

- Fleet fuel cards are payment cards used to purchase gas and pay for certain maintenance costs.

- These fuel cards work like most charge or credit cards but may require additional information about the vehicle and can provide a comprehensive spending report.

- Small and large businesses can use fleet fuel cards, though they are primarily recommended for companies that buy over 1,000 gallons of fuel each month.

Driver-related expenses are one of the top challenges in the trucking industry as fuel and maintenance costs continue to rise, exceeding $2.25 per mile as of 2022. Fleet fuel cards are convenient for lowering fuel costs, consolidating fleet expenses and tracking business budgets.

Fuel cards are both cost-effective and time-efficient. They allow business owners to restrict and monitor employee spending with comprehensive, real-time reports. Knowing how much your employees spend on fuel while benefiting from discounts or rebates helps improve your fleet management system and boost your bottom line.

Keep reading for our recommendations of the best fleet fuel cards, plus a breakdown of what they are, how they work and how they can benefit your business.

Top fleet fuel cards for businesses

Before you choose a gas program for your fleet, be sure to consider all of your options. Comparing fleet fuel cards helps you understand key differences. This includes features like automatic International Fuel Tax Agreement (IFTA) reporting and potential fuel rebates.

We find that the following fleet fuel cards meet those standards:

AtoB fuel cards

AtoB’s fuel cards, the AtoB Flex and AtoB Unlimited, offer some of the best discounts, allowing you to save up to $1.85 per gallon on diesel fuel and 5 cents per gallon on unleaded fuel. But, to benefit from these rebates, your drivers must use AtoB’s app to locate fueling stations.

| Pros | Cons |

|---|---|

| High discounts available | Discount availability is dependent on app usage |

| Can use the card anywhere Mastercard is accepted | Security features only available with AtoB Premium |

| Opportunities to get cash back for using the AtoB app | Additional setup and monthly fees |

| Must pay off the balance each month |

WEX card

Like AotB, WEX offers two fuel cards: the WEX Fleet Card and the WEX Fleet FlexCard. WEX fuel cards offer discounts based on your monthly fuel purchases. However, a major benefit for larger fleets is the flexibility to use the card at over 45,000 fueling stations.

| Pros | Cons |

|---|---|

| Can be used at 95% of gas stations in the U.S. | May incur high fees for unpaid balances |

| Real-time transaction tracking | No rewards or cash back for nonfuel purchases |

| No additional setup fees |

Coast Fleet Card

Partnered with Visa, the Coast Fleet Card is a versatile option with several incentives for use at designated stations. It offers a higher rebate of up to 10 cents per gallon compared to a standard 2 cents per gallon at all stations. This card automatically monitors and documents data for all fuel transactions to simplify your fleet expense management.

| Pros | Cons |

|---|---|

| Save up to 10 cents per gallon | Must pay your balance in full each month |

| Can be used anywhere Visa is accepted | Late or returned payments incur a $35 fee |

| May offer 1% cash back for nonfuel transactions | |

| No setup fees |

Exxon Mobil card

Limited to use at Exxon and Mobil fueling stations, the Exxon Mobil card has a tiered rebate structure, offering higher rebates of up to 6 cents per gallon the more gallons you purchase each month. Though brand-specific fuel cards may be limiting, Exxon and Mobil have over 12,000 locations with one of the largest networks in the U.S., but you can use your card at more places for an added fee.

| Pros | Cons |

|---|---|

| Save up to 6 cents per gallon | Can only be used at Exxon and Mobil stations |

| Real-time transaction alerts | Additional setup and monthly fees |

| Provides reports on mileage and miles per gallon |

Shell card

Specific to Shell stations, there are three Shell fuel cards to choose from: Shell Fleet Plus, Shell Small Business and Shell Fleet Navigator. Depending on the card, you can save up to 6 cents per gallon with additional rebates.

Only the Fleet Navigator card can be used outside of Shell stations, but all Shell fuel cards can be used at certain Jiffy Lube locations for preventative maintenance services. In some cases, you can use your Shell card to pay for other services like electric vehicle (EV) charging.

| Pros | Cons |

|---|---|

| No setup, annual or monthly fees | Limited for use at Shell stations |

| Discounts are available at participating Jiffy Lube locations | Best rebate discounts apply to minimum purchases of 10,000 gallons each month |

Fuelman card

Fuelman offers multiple fuel cards, including mixed fleet and diesel, at three different levels—basic, pro and enterprise—to suit your needs. All cards can be used at more than 40,000 fueling stations in the Fuelman network, and they offer rebates of up to 12 cents per gallon and customizable dashboards.

The Fuelman Mastercard is a more flexible option, which you can use at any location that accepts Mastercard, but rewards, features and rebates are limited compared to the other options.

| Pros | Cons |

|---|---|

| Three tiers for fleet cards depending on fuel and expense tracking needs | Additional monthly fees of up to $99 per month |

| No setup fees | Incurs high fees for any missed or returned payments |

| Accepted at over 40,000 locations | Must pay your balance in full each month |

Sunoco card

Unlike other brand-specific programs, only one of Sunoco’s fuel cards can be used exclusively at any 5,000 or more Sunoco locations, while you can use the other at 95% of U.S. fueling stations. Choose the business fleet card for better discounts, but if you’re looking for flexibility, the universal card may better serve your needs.

| Pros | Cons |

|---|---|

| No setup, monthly or annual fees | Discounts apply only at 5,000 Sunoco stations |

| Real-time tracking, alerts and reporting | |

| Savings of up to 6 cents per gallon |

What are fleet fuel cards?

Like other business credit cards, fleet fuel cards are used to purchase fuel on the business’ account with an extensive reporting system to track spending in real time.

Fuel cards offer competitive gas and diesel rebates once the business has purchased a predetermined amount of fuel, often between 1,000 and 10,000 gallons.

How do fleet management fuel cards work?

Fleet management fuel cards operate differently depending on the type of card you choose. Depending on the size of your fleet, your typical fuel expenses and your fleet fuel management goals, different cards may be better suited to your needs.

The three main types of fleet fuel cards include:

- Fleet fuel credit cards: These fuel cards, partnered with major credit card companies, offer great flexibility. They can be used virtually anywhere the credit card is accepted.

- Branded fuel cards: These cards offer some of the best discounts and rebates but can only be used at specific chains like Shell or Mobil and may require a high fuel purchase requirement.

- Cards from fleet management companies: Offered by major names like WEX and Fuelman, these cards can simplify expense management by negotiating discounts with a large network of gas stations and maintenance retailers.

Benefits of fleet gas card programs

Participating in a fleet gas card program can help increase fuel efficiency and improve how you track and manage fleet spending.

Before you choose which fleet fuel card is right for your business, look for the following features to maximize the benefits available.

Discounts on fuel purchases

Fuel rebates and discounts quickly add up with a fleet fuel card. Be sure to shop around for the best offer, whether that’s more cents off each dollar spent on fuel or flexibility to use the card at different gas stations.

Real-time expense tracking

Compared to other business charge cards or credit cards, one of the most impactful features of a fleet card is the ability to monitor and control employee spending. It allows the card owner to limit spending and track trends in categories like effectively:

- How much fuel is purchased in each transaction

- The amount of fuel purchased each day, week or month

- Where employees purchase fuel at what price per gallon

- Trends in fuel acquisition and consumption

Fuel card integrations

Enrolling in fleet fuel card programs that integrate with your fuel management app can maximize the benefits. While you can use fleet fuel cards and fleet management apps separately, compatibility between these tools can simplify budgeting, expense tracking, and efficiency improvements.

Whether you have a small fleet or a large one, here are a few ways you can use these highly recommended fuel management card integrations:

- BlueArrow Fuel: Detect time theft, monitor fuel card use, simplify transaction approvals, confirm location plus fuel amounts and costs

- Fleet Hoster's FuelBI: View and visualize fuel transactions, analyze KPIs, track misuse, handle daily transactions

- FLEETCOR’s Fuel Card Integration: Track real-time fleet location, monitor fuel card data, detect and report potential fraud

- Didcom’s Fuel Level Monitor: Analyze fuel consumption, avoid fuel theft, improve fleet efficiency

- Impac Fleet’s FuelSync: Monitor spending patterns by location, analyze fuel transactions by type

- AtoB: Track fuel levels, direct drivers to cost-effective stations on routes

- RoadFlex: Identify lowest cost fuel stations, block fraudulent transactions using GPS tracking, limit fuel by tank capacity

- U.S. Bank Voyager Fleet Card: Track fuel purchases and consumption in real-time, analyze vehicle efficiency, simplify the tax payment process

Who are fleet fuel cards for?

Businesses of all sizes that use a fleet of vehicles can take advantage of fleet fuel cards. Whether they’re local service providers or a national long-haul trucking business, fuel cards can offer fuel discounts while increasing reporting standards, accountability and overall fleet efficiency.

Although the best fuel cards for small businesses and large enterprises have overlapping qualities, a small business should seek out fleet fuel cards with lower fuel minimums. Small businesses should also seek cards offering flexibility in reward applications or those applicable to local fuelling locations.

Using a fleet fuel card can save your business money and improve your fleet productivity. Fleet fuel cards offer real-time expense tracking, spending reports, and competitive fuel discounts. These tools empower you to manage budgets, monitor spending habits, and make informed decisions that improve cost-effectiveness and fuel efficiency.

Pair your fuel card program with compatible fuel management integrations to maximize your fleet’s performance and improve expense management.

Subscribe to get industry tips and insights

Frequently Asked Questions

The best fleet fuel card for your business depends on the size of your fleet and your unique business needs, but you should look for a card that:

- Offers competitive discounts and rebates at your most used fueling stations

- Provides the expense monitoring, GPS tracking and reporting services you need

- Allows you to limit spending and monitor how each vehicle consumes fuel

In most cases, fleet fuel cards are worthwhile because they increase cost-savings and fuel efficiency, automate expense tracking and reporting, and improve overall fleet management for better ROI.

Any business with active company vehicles may be eligible for fleet fuel cards regardless of the size or type of company, including:

- Plumbing, roofing, electrical and other local service providers

- Shipping and logistics companies

- Delivery drivers

- Public transportation providers

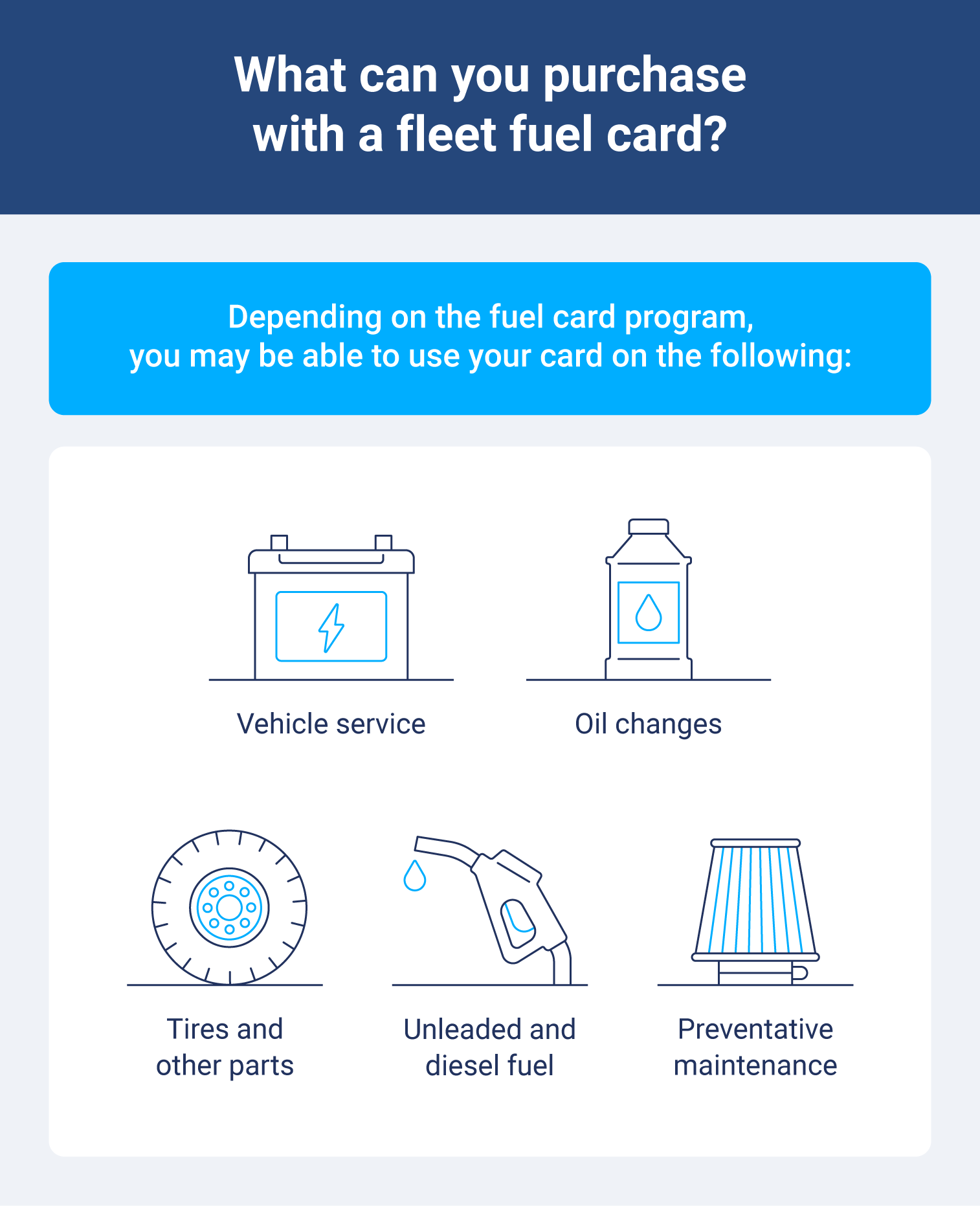

A fuel card can almost exclusively be used at gas stations to purchase fuel, while a fleet card may be more versatile and apply to other vehicle expenses. Some fleet fuel credit cards can also be used on parts and maintenance, but all fleet cards are limited to specific purchases and often have spending limits.

Many fleet cards are available with no setup, monthly or annual fees, including:

- WEX FlexCard

- Shell Small Business Card

- Sunoco Business Fleet Card

- AtoB fuel card

Shop around for the best rebates and value for your fleet. Cards with added fees may offer better benefits for your business needs.

Fleet cards may be used at different fuelling locations and service stations, but the specific uses depend on the card you use. Some fleet cards for fuel restrict spending to unleaded gas or diesel, while others can be used on other vehicle expenses.

The Geotab Team write about company news.

Table of Contents

Subscribe to get industry tips and insights

Related posts

Ultimate heavy equipment transport guide: Top tips and systems for fleets

April 21, 2025

6 minute read

Ultimate field service management software guide [benefits + options]

April 21, 2025

5 minute read

Building a world-class driver training program: Essential strategies for truckload carriers

April 15, 2025

4 minute read

Marketplace Spotlight: From Chaos to Clarity, Innovating Fleet Claims with Xtract

April 15, 2025

1 minute read

Embracing public safety technologies in the face of opposition

April 15, 2025

4 minute read

What is government fleet management software and how is it used?

April 10, 2025

3 minute read