4 biggest challenges in the trucking industry

An overview of key challenges and updates in the trucking industry, including truck parking, electronic logging and driver recruitment

By Geotab

Apr 24, 2023

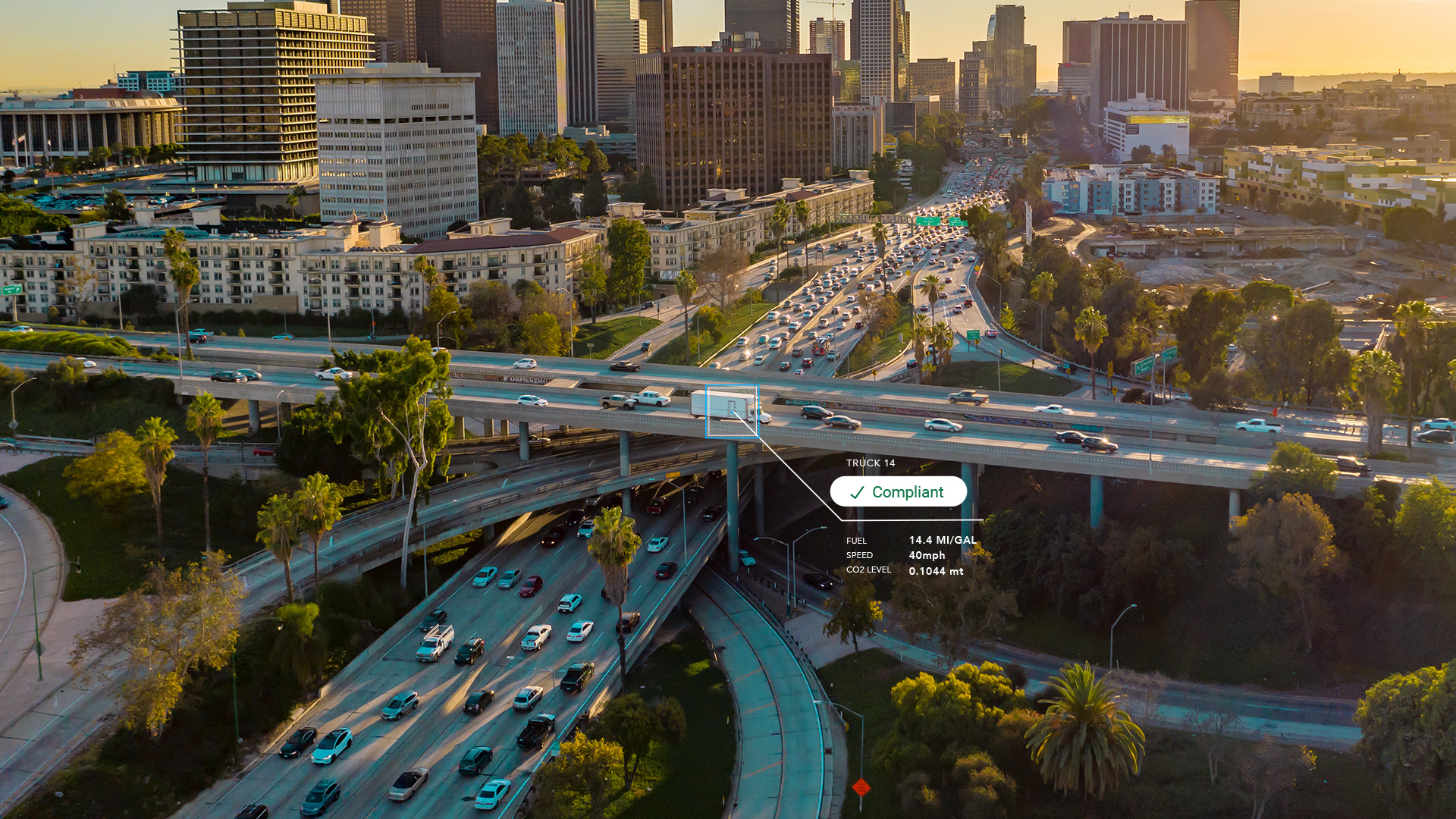

Geotab takes a look at the trucking industry, including top challenges and key improvement projects. Currently, there are four major areas affecting the industry: parking, driver recruitment, Hours of Service (HOS) regulations and electronic logging.

Overview of key challenges in the trucking industry:

- Parking shortage: Increased freight means more trucks and fewer parking spaces.

- Driver shortage: More trucks mean more drivers — on top of an existing driver shortage problem.

- HOS regulations: Hours of Service (HOS) rules continue to undergo debate, and a new proposal could change the rules for drivers altogether.

- Electronic logging: Now that the ELD Mandate is in full effect in the U.S., how has it impacted the industry? And what is the status of the Owner-Operator Independent Drivers Association (OOIDA) exemption for small businesses and owner-operators?

See also:

Blockchain in trucking: Could it change the industry?

Solving over the road trucking challenges with analytics

Truck parking shortage

The Federal Highway Administration (FHWA) provides a dramatic look at the volume and value of the goods that trucking is responsible for across all modes in the supply chain in their most recent report to Congress on highway freight transportation. Trucking represents 59.9% of domestic freight transportation (tonnage), far surpassing rail (8.9%), air (0.1%) and other modes.

According to the FHWA report on the state of highway freight transportation, freight tons are expected to grow by almost 45% in the next 30 years. More freight means more trucks at any given rest stop or truck stop.

The FHWA reports that drivers are all too aware of the issue, with 75% reporting in a survey that they have a growing concern for safe truck parking in all states “when rest is needed,” and 90% reported that they struggle to find safe parking at night. This can be especially concerning around urban areas, which can be seen in the two maps below from the FHWA report.

While some may think there is plenty of parking out there, remember that roadside and other unofficial parking areas are not considered safe for any driver. That means areas that are safe can get clogged up quickly.

In the FHWA survey, the respondents reported the top “problem areas” (or areas where safe or designated parking is often at capacity or unavailable altogether) as:

- Public rest areas

- Freeway interchange ramps

- Freeway shoulders

- Highway roadsides

- Commercial areas

The report recommended the following to address the issue of parking shortages, with a focus on long-term solutions:

- Collect more data and analyze it as part of regional, state, and local freight plans, especially in freight corridors and urban areas.

- Gain better insights to the supply chains of “key industries and major commodities,” as well a better understanding of how freight moves “to better anticipate and plan for parking needs.”

- Local regulations should be reconsidered and even zoning requirements to ease the development of truck parking/facilities.

- Coordination between private and public sectors to “address long-term parking needs.”

While these recommendations are broad, it does get the conversation started in how data and freight planning could be used to address the problem.

One organizational effort that is working to address the problem is the Truck Parking Information Management Systems (TPIMS) project spearheaded by 8 states: Kansas, Iowa, Minnesota, Wisconsin, Michigan, Indiana, Ohio, and Kentucky. The project, which is scheduled for a soft launch in fall 2018, will use sensors to monitor parking at private and public rest stops in more than 150 parking sites along high-volume freight areas, and will provide available parking info to drivers via signs, mobile apps and websites.

Geotab provides free access to data on truck parking locations and how busy they are on data.geotab.com. These location analytics can be used to help drivers find the nearest parking spaces or truck stop locations. Learn more on data.geotab.com.

Driver shortage

The industry continues to undergo a significant driver shortage. As the FHWA report points out, within freight transportation, truck driving is the largest occupation with nearly 3 million drivers. The Washington Post reports that the industry was short 51,000 drivers at the end of 2017, compared to 36,000 in 2016. The ATA expects it to increase even more by the end of 2018, and if current trends continue, could reach more than 174,000 by 2026. What’s worse is that due to the industry growth, turnover, and the rate of retiring truck drivers, the ATA estimates that the industry will have to hire nearly 900,000 new drivers over the next decade to close the gap.

The organization’s top recommendation for carriers in dealing with the problem on the short term? Technology. By using dispatching programs, and GPS and telematics, fleets can better manage routes and better predict traffic conditions.

There are other efforts happening as well in the legislative category. The latest development is an attempt to open up the labor pool for truck driving jobs via the introduction of the DRIVE-Safe Act (H.R. 5358), which is supported by the ATA and numerous other trucking organizations.

The legislation, which stands for Developing Responsible Individuals for a Vibrant Economy Act, if passed would allow apprenticeship programs for drivers between the ages of 18 and 21, whereas currently a driver must be at least 21 years old. “Moreover, this bill would strengthen training programs beyond current requirements to ensure safety and that drivers are best prepared,” said ATA President and CEO Chris Spear on the legislation. Drivers in the training program would have the opportunity to use trucks safety technology such as active braking collision mitigation systems, video event capturing systems, and speed governors.

Meanwhile, carriers have been finding their own solutions to attract more drivers with some increasing pay. This small carrier increased driver pay twice in a six-month period, as well as increased vacation time and vacation for first-year employees. The owner even made a plea to Hollywood to make more movies like Convoy to help entice people into the career.

Hours of service

A new regulation has been proposed to change and create more flexibility in HOS reporting. The Honest Operators Undertake Road Safety Act (H.R. 6178) or HOURS Act, is also backed by the ATA and was referred to the House Committee on Transportation and Infrastructure in June 2018. The ATA states that since the ELD rollout, the industry has gained visibility to the current HOS rules, and that these rules should be modified using the ELD data.

The legislation looks to make the rules more flexible in four main areas:

- Seeks exemption for haulers of livestock or agricultural products within 150 air-miles of the load source, both in and out of planting or harvest season.

- Seeks exemption for all short-haul truck drivers who drive within 150 air-miles of the reporting location and complete their workday in under 14 hours (thus ending the two-tiered system currently for short-haul drivers).

- Seeks to reduce the supporting documentation requirements to only having to verify the driver’s start and end time during on-duty periods.

- Seeks to address issues already raised on how drivers in sleeper berths can split their rest time when during off-duty periods.

Electronic Logging Devices (ELDs)

Since the ELD mandate went into its soft rollout in December 2017 and its full rollout April 1, the Federal Motor Carrier Safety Administration (FMCSA) has seen a steady drop in HOS violations. Prior to the rollout in December 2017, the percentage of driver inspections that resulted in at least one HOS violation, typically hovered between 1.16% and 1.36%. Between December and January, however, it dropped to 0.83%, and as of May, it was 0.64%.

Additionally, despite industry concerns about adoption rates, the FMCSA reports that less than 1% of all driver inspections found the driver without an ELD or grandfathered AOBRD device. Other independent surveys have found similar adoption patterns, with many citing 95% and above.

Citing the positive impacts of ELDs, one group, the Trucking Alliance, is calling for states to start passing intrastate ELD laws, and drafted a policy statement July 20 urging the FMCSA and state legislatures to take action.

On the opposite end, some smaller carriers and owner-operators, represented by the Owner-Operator Independent Drivers Association (OOIDA), had been seeking an exemption, but as of early July, the request was denied by the FMCSA. There is still one exemption request pending from the Small Business in Transportation Coalition, and as of this writing. This request seeks to exempt carriers that employ fewer than 50 drivers.

These organizations aren’t alone. Two bipartisan bills were introduced in Congress earlier this year that also seek exemptions: one for agricultural-related businesses (e.g. farms), the Agricultural Business Electronic Logging Device Exemption Act of 2018, and the other to exempt businesses with 10 or fewer commercial vehicles, the Small Carrier Electronic Logging Device Exemption Act of 2018. Both bills were referred to the Subcommittee on Highways and Transit as of May 24, and would need to be passed before the 115th Congress closes session by January 2019, otherwise the bills would have to be reintroduced.

For more updates and ELD news, subscribe to the Geotab newsletter. You can also find info on Geotab’s Cloud ELD solution on our compliance page.

See also:

Transport Canada ELD Mandate — What we know

4 ELD violations that could impact your CSA Score and how to avoid them

Subscribe to get industry tips and insights

Geotab

Geotab team

Table of Contents

Subscribe to get industry tips and insights

Related posts

Infographic: Upgrading your cold chain solution to minimize waste and maximize profit

September 11, 2025

1 minute read

Enhancing winter road maintenance with postseason materials usage analyses

June 20, 2025

6 minute read

CARB compliance made easy: 10 ways Geotab simplifies emissions reporting

May 12, 2025

1 minute read