Cut commercial fleet insurance premiums with safe driving data

Utilize your safe driving habits to get accurate insurance estimates

Incentivize safe driving habits with costs savings

60%

reduction in collisions

PepsiCo

$117k

saved in insurance costs annually

Fueliner

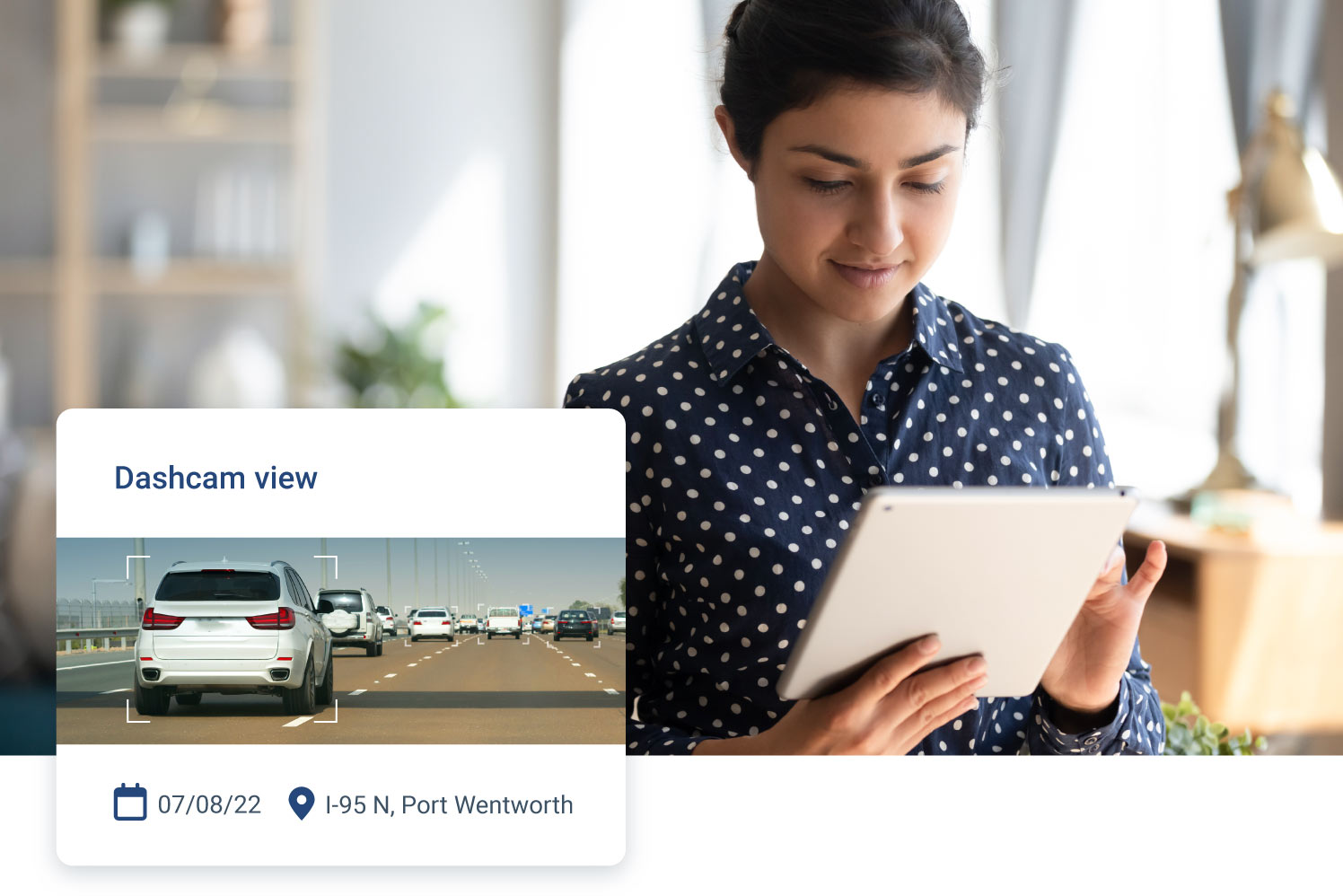

Protect your fleet with dash cam integrations

100%

reduction of false insurance claims

Euroloo

13%

decrease in severe alerts related to driver safety

Plastic Express

Standard commercial auto insurance coverage

What does fleet insurance cover?

Fleet insurance provides coverage for vehicles used to help a business operate. Most basic policies include:

- Third-party bodily injuries

- Third-party property damage

- Damage to your own vehicle

- Injuries to your own driver

What if I need more?

Insurance policies offer the flexibility to add on additional coverages based on your needs, including:

- Collision coverage if your driver is at fault

- Comprehensive coverage for natural disasters

- All perils coverage

- Specific perils coverage

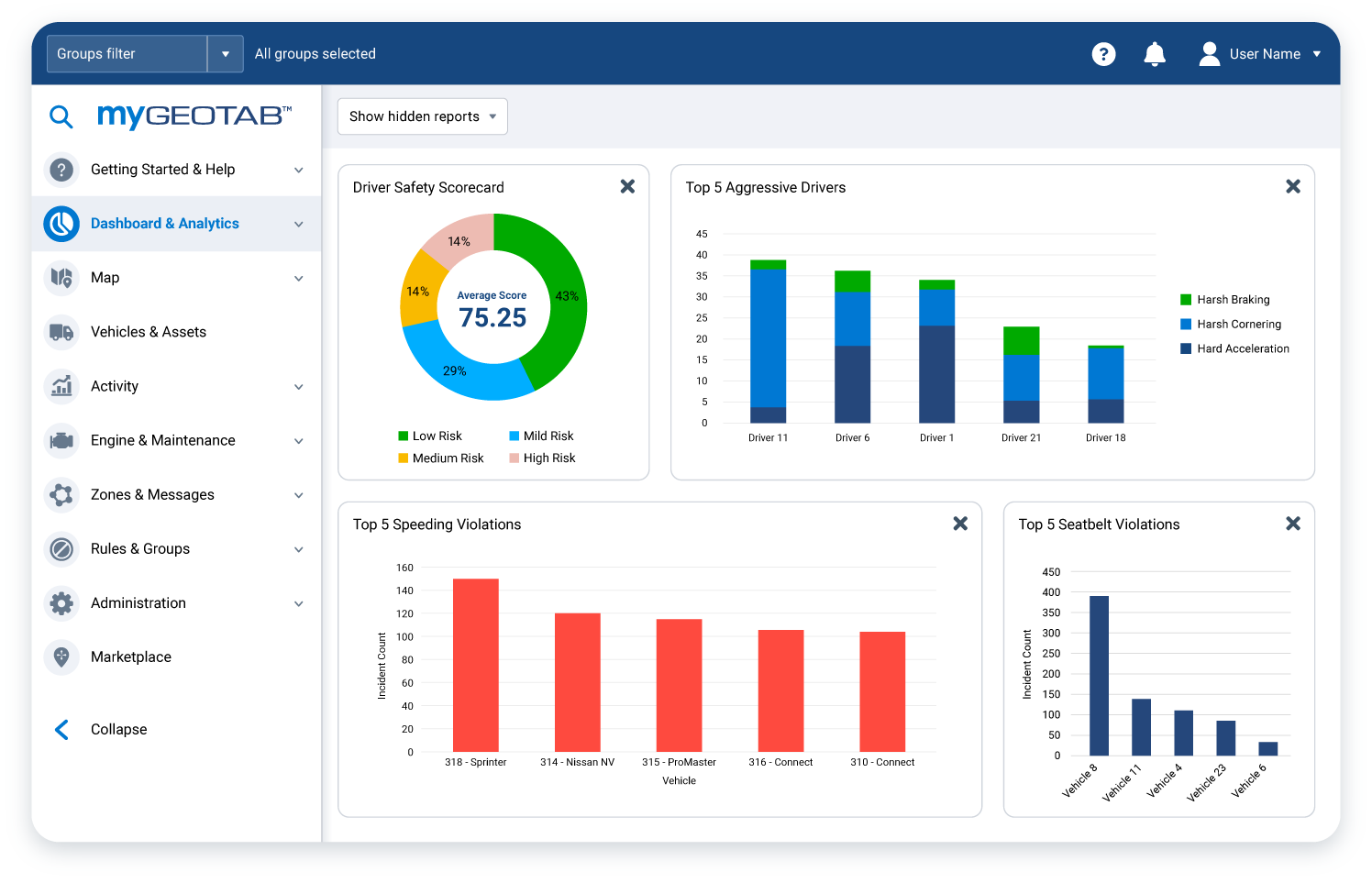

Usage-based fleet insurance benefits

Save time

Set up your fleet insurance faster and easier than before with a simple three-step process.

Save money

Earn up to 20% savings on your fleet insurance premium based on safe driving behavior.

Better driver coaching

Incentivize drivers to be safer on the road by implementing comprehensive driver coaching solutions.

Reduce liability

Lessen your chances of collisions and risky driving behavior by bolstering your safety efforts with our partners.

Streamline your operations

MyGeotab makes it easy to pull safety and operational data in a couple of easy steps for any insurance provider.

Improve driver safety

Use actionable insights to keep your drivers safe on the road while saving on commercial fleet insurance.

Fleet insurance resources

Case study

D.M. Bowman Inc.: Improve driver safety and get real-time data

“We do have some other ways we can figure out where a truck is, but hands down most of our fleet managers will turn to the Geotab website to quickly locate where a truck is at any given moment [...] We’re constantly trying to figure out more ways to pull data out to continue to improve what’s going on with drivers to reduce our accidents and cost severity”

Barry Wertz, Director of Safety and Risk Management, D. M. Bowman Inc.

20%

reduction in incident costs

Fleet Insurance: The Complete Guide

Want to learn more about the benefits of fleet insurance for your business? Find answers to all of your questions and more in our complete guide, including:

- What is fleet insurance?

- How much does fleet insurance cost?

- What is usage-based insurance?

- How to use safety data to cut down on insurance costs

Fleet insurance solutions from Geotab Marketplace

Frequently Asked Questions

Why choose Geotab?

What types of vehicles can I insure?

How much does fleet insurance typically cost?

• Intended use

• Age, condition and value of vehicles

• Types of vehicles in the fleet

• Policy options — coverages chosen and liability limits

How to lower fleet insurance premiums?

What is the minimum vehicle requirement for commercial fleet insurance?

Key definitions:

• Bodily Injury liability: if a vehicle in your fleet causes injury to another person, this type of insurance will cover the damages. Bodily injury coverage will usually include funds for a defense.

• Property Damage liability: If a vehicle in your fleet damages another person’s property, you’ll turn to this coverage. Property damage liability generally covers funds for legal defense if your organization is sued over property damage.

• Combined Single Limit (CSL) Liability: This coverage option consolidates your policies by providing one overall limit for bodily injury and property damage claims against you rather than two separate limits.