International Fuel Tax Agreement (IFTA) reporting software

Save time. Improve accuracy. Automate your IFTA reporting process with Geotab.

What is IFTA?

The International Fuel Tax Agreement (IFTA) is a fuel tax collection and sharing agreement among member jurisdictions in the U.S. and Canada for the redistribution of fuel taxes paid by motor carriers. In general, IFTA applies to commercial motor vehicles used for businesses purposes that travel between multiple states and/or provinces.

IFTA licence

Carriers must apply for and obtain an IFTA licence for qualified motor vehicles that travel in more than one IFTA member jurisdiction. Qualified motor vehicles are defined by the IFTA Articles Agreement as motor vehicles which are used, designed or maintained for the transportation of persons or property. Two decals must be added onto each qualified motor vehicle once the IFTA licence is obtained. These decals must be annually renewed.

Simplify IFTA fuel tax reporting

Easily import fuel card data into MyGeotab or configure a partner fuel card integration instead of adding up receipts manually. Fuel transactions will be added to the MyGeotab IFTA report.

Increase accuracy with IFTA Automation

Reduce the risk of potential issues such as missing paperwork, errors or overpayments. Automated IFTA reporting of mileage with telematics means greater accuracy.

Video

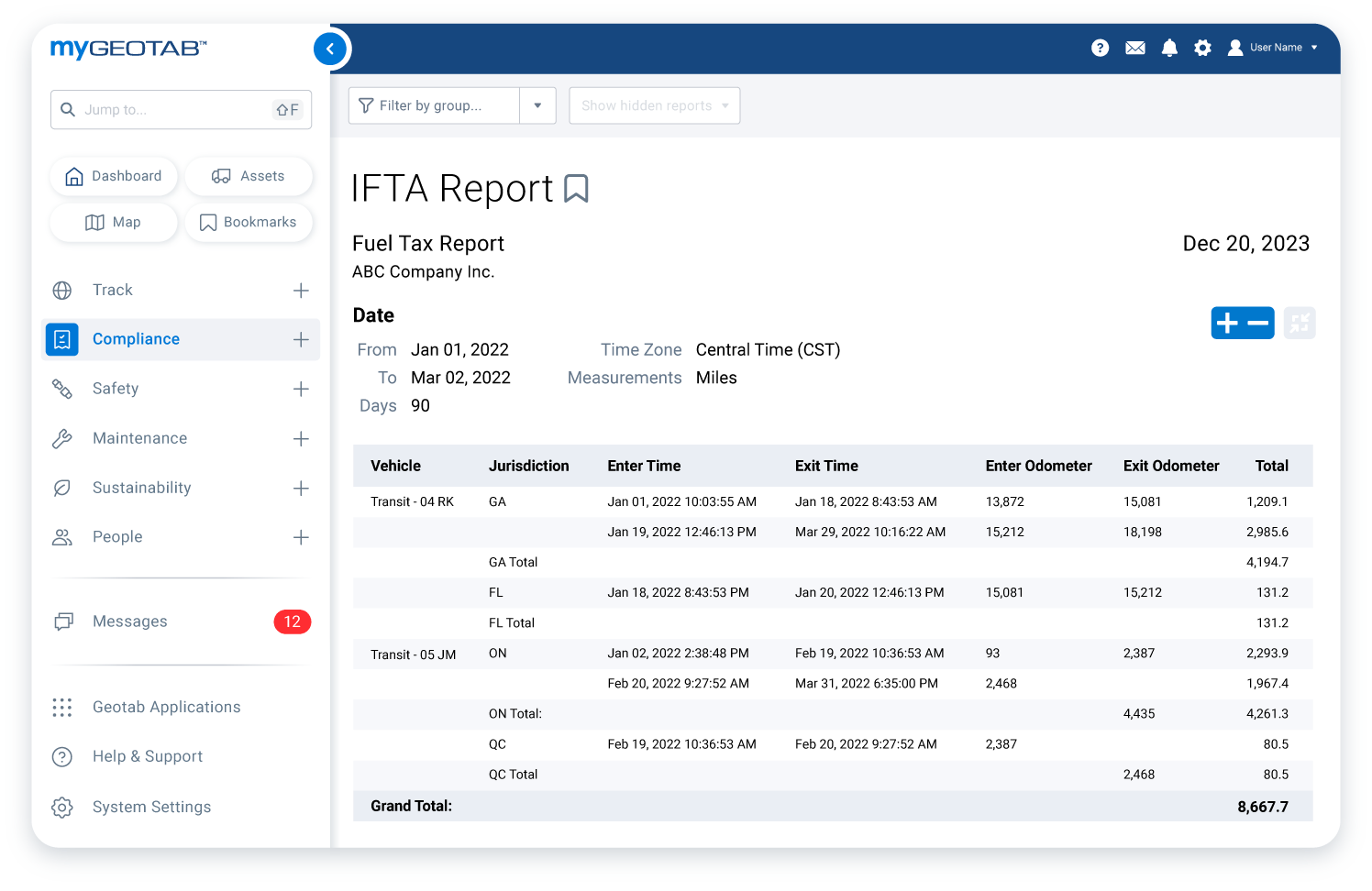

How to run an IFTA report

Learn how to run Geotab’s IFTA report. Review the amount of fuel consumed and the distance traveled in each jurisdiction.

Watch video

Marketplace

IFTA solutions from Geotab Marketplace

Streamline ELD compliance, vehicle inspections, driver ID and more. Solutions include Geotab Drive, elogs, ELD, DVIR and IFTA reports, and solutions for trailers and tachograph.

See solutionsCommonly asked questions

What is IFTA?

IFTA stands for International Fuel Tax Agreement. It is an agreement between the lower 48 states in the U.S. and the 10 Canadian provinces, designed to simplify fuel tax collection and streamline fuel use reporting for interstate commercial motor carriers operating in multiple jurisdictions.

Why is IFTA required?

Federal law requires all commercial carriers who meet certain criteria to comply with IFTA regulations. If your truck meets the criteria, registration is non-negotiable.

Who participates in IFTA?

Participants in IFTA include the 48 contiguous states of the United States, and 10 Canadian Provinces

A commercial vehicle may be considered qualified if they are used to transport goods or people across multiple jurisdictions. Qualified vehicles include trucks with three or more axles, or trucks with two axles and a gross vehicle weight that is more than 26,000 pounds (or truck with trailer that exceeds 26,000 pounds).

There may be instances of a vehicle that may not require an IFTA license despite meeting this criteria, please refer to the official DOT site for details.

How does IFTA fuel tax work?

The IFTA rule is that taxes are paid at the pump and distributed to each state. The taxes are dispersed based on miles driven in a particular state or province.

How does IFTA work/ What is the IFTA operating principle?

To determine how much fuel tax is owed, it is calculated based on where the fuel was consumed. Fuel tax credit is determined based on where the fuel was purchased. IFTA finds the difference between fuel used and fuel purchased for each jurisdiction.

Each member jurisdiction sets its own IFTA tax rate.

Additionally, there are filing deadlines of April 30, July 31st, October 31, and January 31st.

For more information about IFTA, IFTA late penalties, and/or IFTA interest rates, please visit the official website at https://www.iftach.org/

How is IFTA calculated?

To calculate your vehicle's taxable gallons consumed, divide your total taxable miles by your overall fuel mileage, then subtract your total tax for paid gallons purchased for the net taxable gallons.

How often is IFTA filed?

IFTA reports are due quarterly. The deadline to file your IFTA report each quarter is the last day of the month April 30, July 31st, October 31, and January 31st.

For more information about IFTA, IFTA late penalties, and/or IFTA interest rates, please visit the official website at https://www.iftach.org/

What are the benefits of Geotab's IFTA solution?

Once a carrier attains an IFTA license and IFTA decals, the reporting can begin. Geotab's IFTA solution streamlines and consolidates compliance by automating your IFTA reporting process, saving time, improving accuracy and simplifying fuel tax reporting.

Ready to streamline IFTA reporting?

Let us show you how simple it is to use our web-based software and fleet tracking devices to manage IFTA reporting.